Budgeting Capability

Budgeting is a critical aspect of FinOps within your organization, as it enables your organization to set financial targets and track performance against those targets.

Budgeting is a critical aspect of FinOps within your organization, as it enables your organization to set financial targets and track performance against those targets. By creating and managing budgets, your organization can gain a better understanding of their expenses and ensure that you are not overspending in any particular area.

CloudMonitor features related to Budgeting

Budget Management

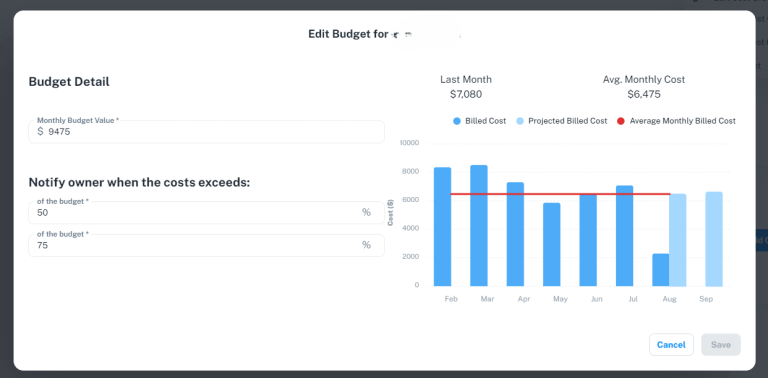

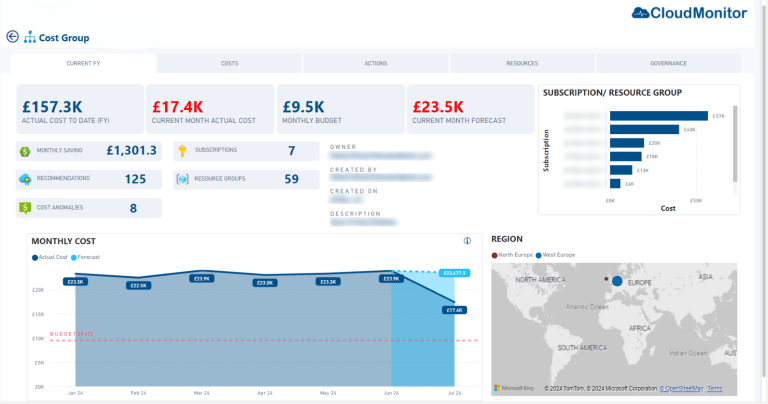

Users can change the suggested budget to any value the prefer. That budget will be displayed in Cost group Page.

Create Cost Groups

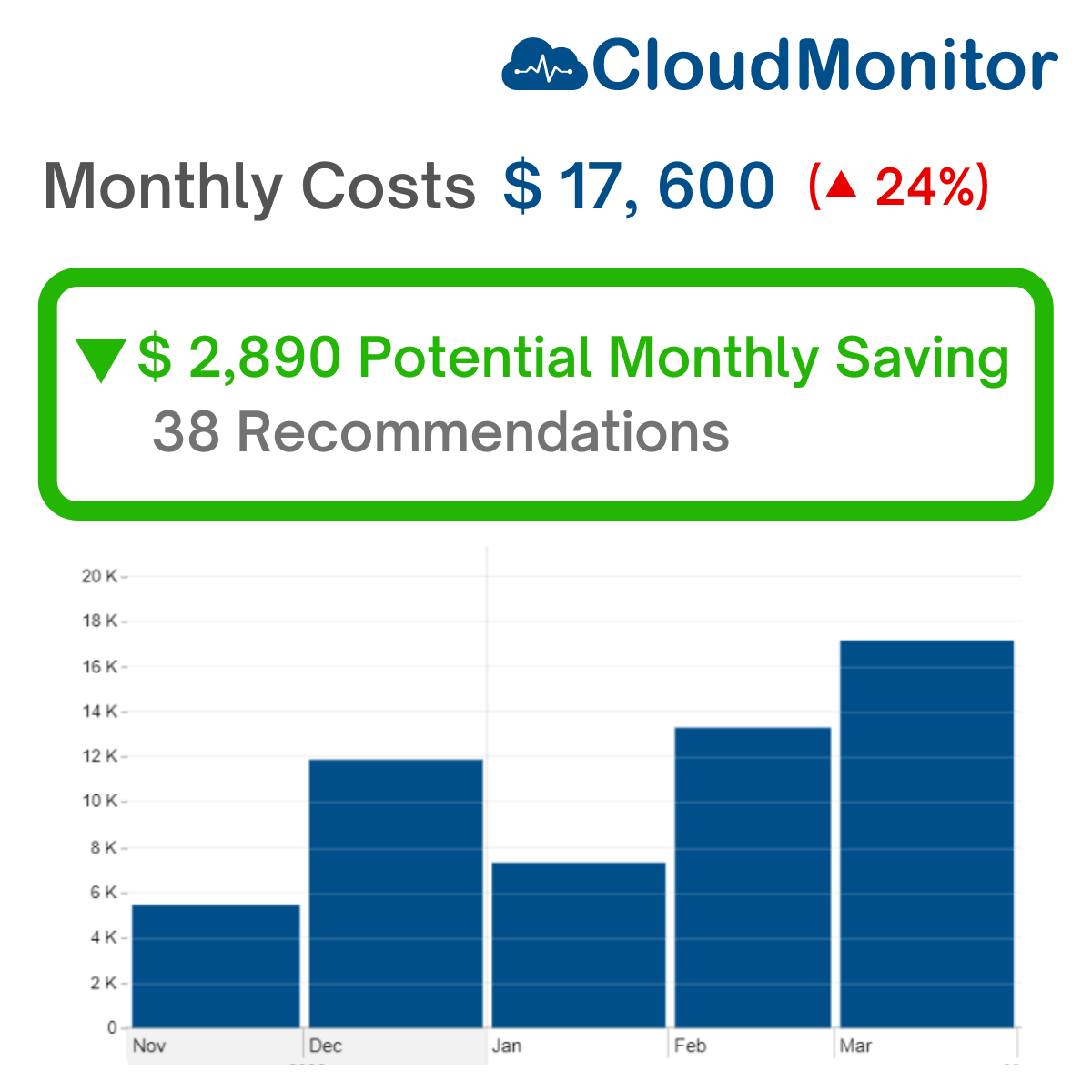

CloudMonitor now suggests a budget by considering average of the cloud spend for each cost group, (Budgets are turned on by default) Cost Group can be defined to any tag or Business Mapping.

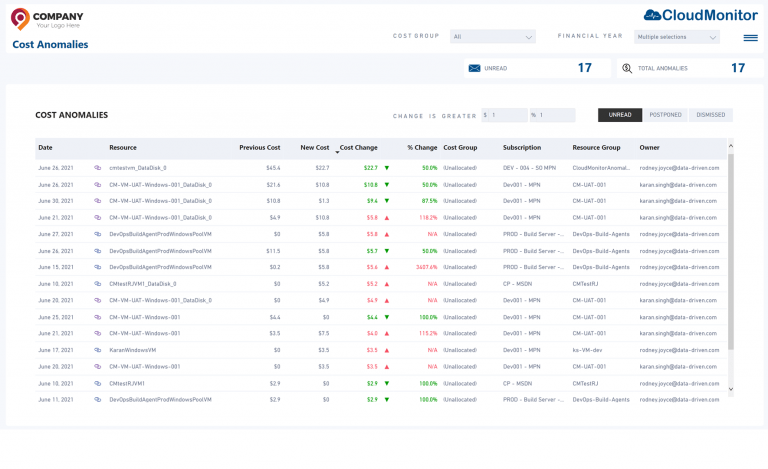

Cost Anomalies

The last step of budget management is investigating the causes of any variances identified in the second step. CloudMonitors Cost Anomaly page can help you by displaying all available cost anomalies so you can find the exact cause of a budget variance.

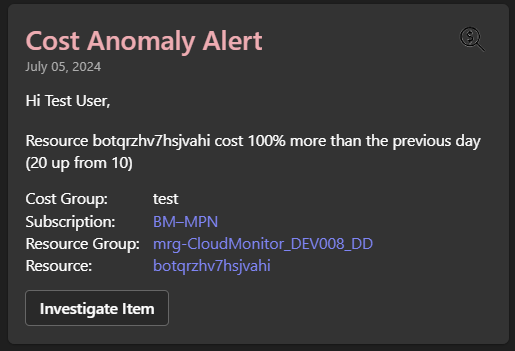

Cost Anomalies Alerts

Receive cost Anomaly alerts on your Teams bot instantly to make efficient decisions.

Budgeting Definition

Budgeting for cloud or other IT expenses involves collecting estimated expenses for a specified period. These budgets serve as a basis for strategic decision-making, operational planning, and investment. When actual expenses deviate from the budget, it can impact the company’s operations and decisions that were made based on those budgets.

The term “favorable to budget” means that there are fewer expenses than planned in the budget. Conversely, “unfavorable to budget” means that there are more expenses than planned in the budget. While being favorable to the budget isn’t necessarily bad, it’s not always ideal. If the budget had more accurately reflected lower expenses, the business might have made different investment decisions or focused on growth in different areas.

Budgeting is the process of accumulating estimated expenses, tracking actuals, forecasting remaining spend, and comparing it to the budgeted amount to identify material variances that are favorable or unfavorable. Investigating the causes of variances is another key aspect of budget management. It enables practitioners to understand why the expenses differed from the budget, identify opportunities for improvement, and take corrective actions.

Effective budgeting is critical for achieving financial goals, operational objectives, and strategic outcomes. By collecting accurate estimates, tracking actuals, and investigating variances, practitioners can ensure that budgets reflect the true cost of cloud or IT expenses, support strategic decision-making, and align with organizational priorities.